The company is a very important perception in the foreign market and financially. “Compound interest” in particular has the power to give your financial journey a new direction. With the help of this multiplier, careful investment and time, you can increase your net worth in many ways.

In this blog, we will understand in detail about “compound interest” and discuss its importance, mechanism, and how it can be useful for your wealth growth.

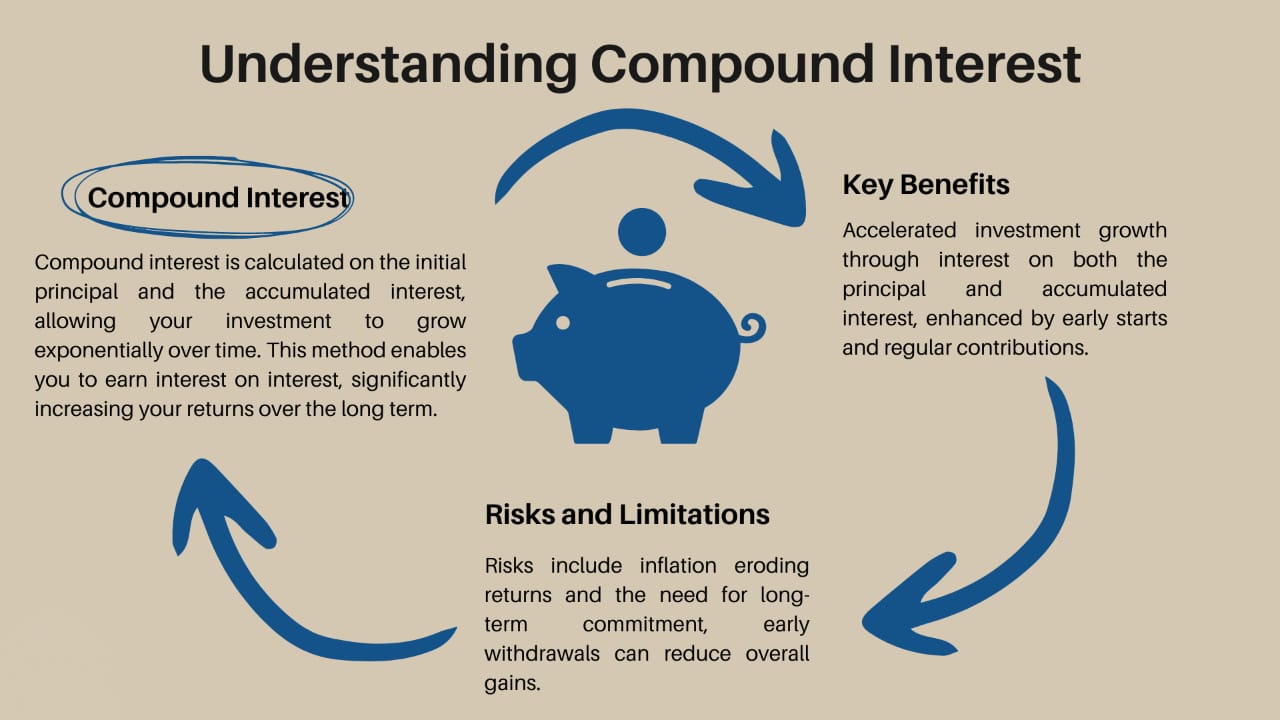

1. What is compound interest?

Compound interest is a type of interest that is applied to both the original investment (principal) and the previous interest. This means, your earnings pay interest on yourself, which will get bigger over time. With careful investment and more time, compound interest becomes a powerful tool to grow your wealth at a faster rate.

A useful example of compound interest:

Suppose you invest Rs 10,000. Thereafter, after the year it earns 10% interest. So, you will earn Rs 1,000 in interest, and your total amount will be Rs 11,000. Now, in the second year, the interest is not only on your Rs 10,000, but 10% (Rs 1,100) on Rs 11,000. This way, your earnings can increase every year.

BUY NOW: THE INTELLIGENT INVESTOR

2. How does compound interest work?

The general formula for the compound interest compounding method is:

A = P(1+r/n)nt

Where:

A = Total amount received in future (Principal + Interest)

P = Principal

r = annual interest rate (ex. 5% or 10%)

n = number of times the interest is to be compounded per year (ex. 12 for 12 months)

t = time (years)

3. Benefit of explaining compound interest:

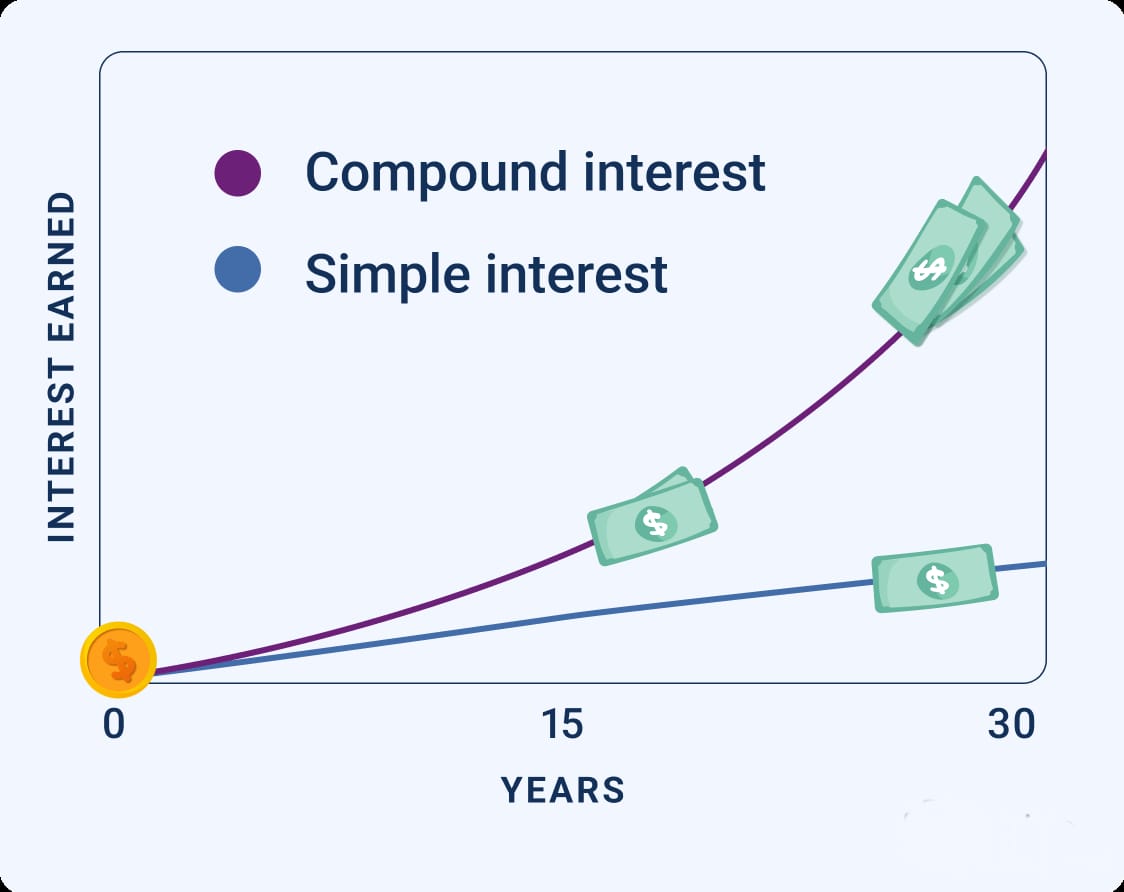

(a) Growth in the long run:

One of the biggest benefits of compound interest is its ability to increase value over the long term. As you earn interest on your investment with interest (mean, time), you earn interest on it. That way, you can start with a lower net worth, but see your net worth grow over time.

(b) Careful investment and timing:

With compound interest, your best friend is time. If you invest in a timely and careful manner, the result can be more than expected. For this, the right tools and techniques should be used to make quick and proper investments.

(c) Higher interest rate:

If you can get an interest rate of 10% instead of 5% per annum, your investment will grow more than 2 times faster. Therefore, it is important to decide on the interest rate.

4. Invaluable view of compound interest:

Compound interest is viewed negatively, it also applies to your unvalued money. For example, if you are burdened with high loan interest rates and home loan interest, at some point it can reduce your net worth.

5. Best options to invest in compound interest:

(a) Stock Market:

Investing in the stock market is the most powerful means of compound interest. When you invest in stocks, they provide interest (dividends) in the form of returns from free shares of the company. Also, company appreciation also helps to increase your wealth.

(b) Mutual Funds:

Mutual funds are convenient schemes that offer returns from small investments. It generates compound interest and builds more capital over time.

(c) Real Estate:

Investing in real estate can also be a strong option. Income from rental property and rising property values increase your net worth.

(d) Fixed Deposits:

Even when investing in fixed deposits, you can reap the benefits of compound interest, especially if you invest for a long time.

6. Calculation of Compound Interest:

Let’s understand this through an example:

You have Rs 50,000 and you put it in a fixed deposit for 5 years at 10% annual interest rate.

After the first year:

A=50,000(1+1000) = 50,000(1.1) = 55,000

After the second year:

A = 55,000(1.1) = 60,500

Third Year:

A = 60,500(1.1) = 66,550

In this way, interest is compounded on interest every year, which increases your net worth.

7. Some tips while investing with compound interest:

1. Invest with a long-term view:

Time is on your side. Maximize your interest rate on investments after 10 years.

2. Consider passive income investing:

Instead of earning only interest from your investments, think of humble ideas that provide passive income (like businesses, funds, etc.).

3. Be an expert in a specific field:

Renovate your land daily, and choose shade with care in the area you invest in.

4. Use the top interest rate, not the normal interest rate initially:

8. Importance of Power of Compound Interest:

When faced with financial stress and life challenges, compound interest is the power you can use to strengthen your finances. This is the process by which you begin to see interest generating interest.

Conclusion:

Compound interest is a powerful tool for making your financial dreams come true. If you take the time and understand its benefits with careful investment, you can grow your wealth very quickly.