Physical Gold vs Digital Gold:

Table of Contents:

1. Introduction: Gold in India – An Emotion and an Investment

2. What Is Physical Gold?

3. What Is Digital Gold?

4. Types of Digital Gold (Gold ETFs, Sovereign Gold Bonds, E-Gold)

5. Historical Gold Prices and Trends

6. Why Gold Is Rising in 2025

7. Comparison Table: Physical vs Digital Gold

8. Pros and Cons of Physical Gold

9. Pros and Cons of Digital Gold

10. Taxation: Physical vs Digital Gold

11. Safety and Storage: Which Is Safer?

12. Liquidity: Which One Is Easier to Sell?

13. Returns Comparison Over Time

14. Ideal Use Cases for Each Type

15. Common Myths and Facts About Gold Investment

16. Gold Buying Platforms in India (Apps, Banks, Brokers)

17. Expert Tips to Choose Between Physical and Digital Gold

18. Mistakes to Avoid When Investing in Gold

19. Frequently Asked Questions (FAQs)

20. Final Verdict: Which One Should You Choose in 2025?

BUY NOW:

1. Introduction: Gold in India – An Emotion and an Investment

Gold isn’t just a metal in India — it’s a legacy. From wedding gifts to festive shopping, Indians have historically trusted gold not only for tradition but also as a safe-haven investment.

But as digital transformation grows, many investors are now asking:

“Should I buy physical gold, or go digital?”

Let’s decode this step by step…

2. What Is Physical Gold?

Physical gold refers to the tangible form of gold that you can touch and store. This includes:

- Jewellery (most common)

- Gold coins

- Gold bars (bullion)

Where to Buy Physical Gold:

- Local jewellers

- Banks (coins and bars)

- Certified dealers

- Government mints (India Gold Coin)

3. What Is Digital Gold?

Digital gold is a virtual method of buying gold online, without taking physical delivery immediately. You buy it via apps or websites, and it’s backed by real gold stored securely by the provider.

You can:

- Invest in small amounts (even ₹10)

- Convert it into physical gold later (if you want)

4. Types of Digital Gold:

A. Digital Gold (via platforms like Phone Pe, Paytm, Google Pay)

- Backed by companies like MMTC-PAMP, SafeGold, Augmont

- Stored securely in insured vaults

- No Demat account required

B. Gold ETFs (Exchange-Traded Funds)

- Traded on stock exchanges

- Requires Demat & trading account

- Returns mirror gold price

C. Sovereign Gold Bonds (SGBs)

- Issued by RBI on behalf of Govt. of India.

- 8-year maturity with 2.5% interest per annum.

- Can be traded or redeemed early.

D. E-Gold

- Offered by NSEL earlier; currently not active.

- May be reintroduced in future with regulation.

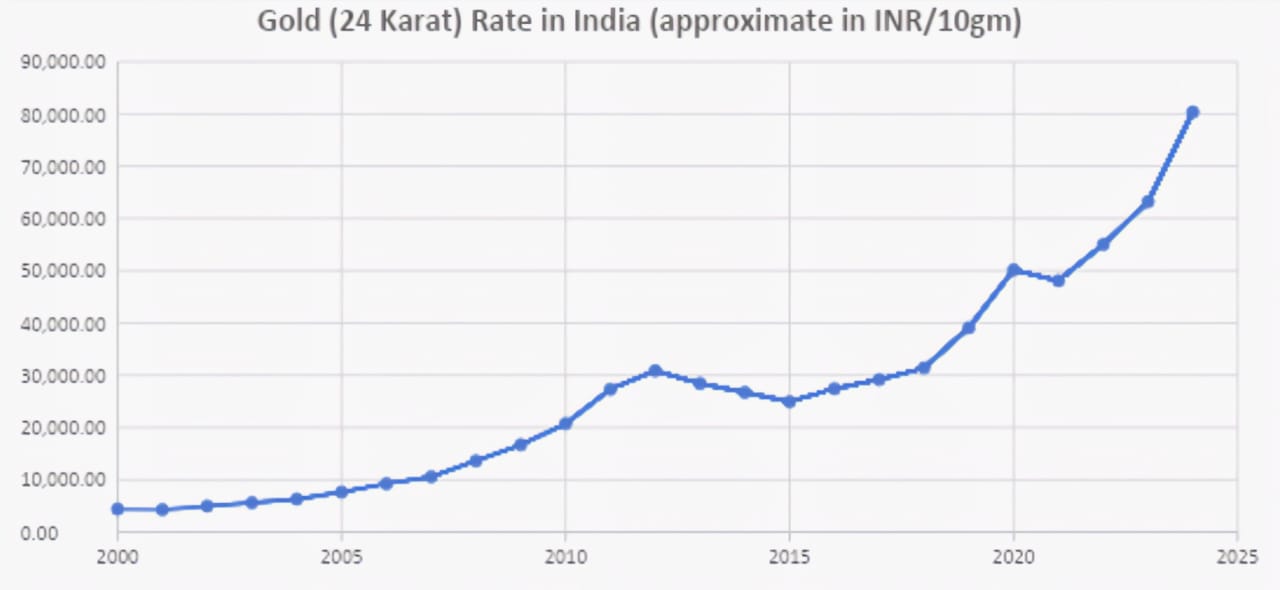

5. Historical Gold Prices and Trends:

chart from 2000 to 2025 showing rising prices.

6. Why Gold Is Rising in 2025?

- Rising inflation globally

- High central bank buying

- Uncertain global economy

- Safe-haven demand

- Rupee depreciation

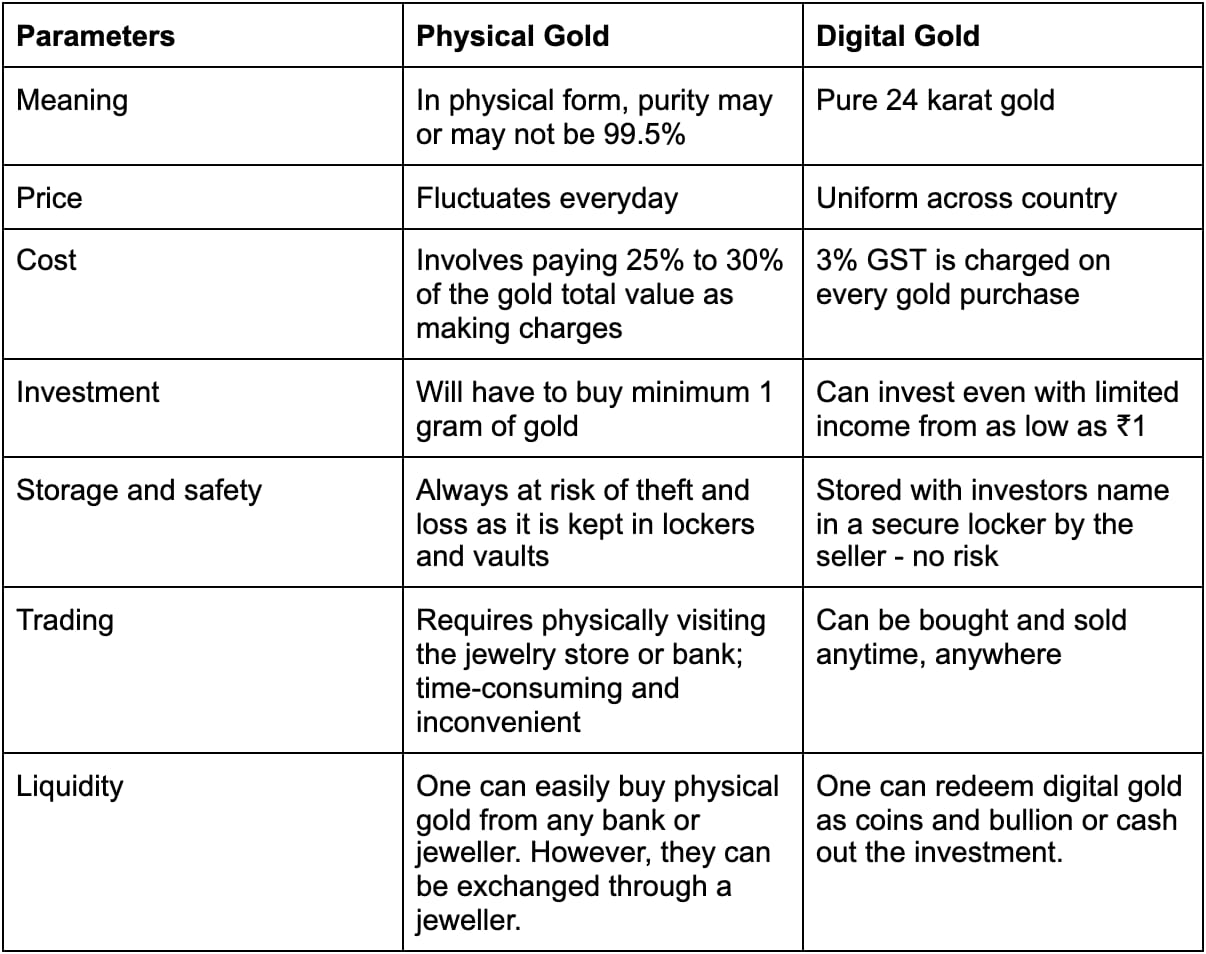

7. Comparison Table: Physical vs Digital Gold

8. Pros and Cons of Physical Gold

Pros:

-

Tangible asset – you can see and hold it.

-

Universally recognized and accepted.

-

Can be used as jewelry or passed on as inheritance.

-

No reliance on digital infrastructure or third parties.

Cons:

-

Risk of theft, damage, or loss.

-

Requires secure storage and sometimes insurance.

-

Lower liquidity compared to digital gold.

-

Additional costs like making charges (for jewelry).

-

Difficult to verify purity unless from a certified source.

9. Pros and Cons of Digital Gold

Pros:

-

Easily accessible via mobile apps/web platforms.

-

No storage or security concerns (stored in insured vaults).

-

High liquidity – can buy/sell in seconds.

-

Can invest in small denominations (even ₹1).

-

Usually backed by 24K 99.99% pure gold.

Cons:

-

Relatively new, may have regulatory uncertainty in some countries.

-

Requires trust in platform and internet access.

-

Can incur platform fees or commissions.

-

Cannot physically access the gold unless requested (may incur delivery fees).

10. Taxation: Physical vs Digital Gold

Physical Gold:

- Attracts capital gains tax on profits.

- If held for more than 3 years: Long-term capital gains (LTCG) taxed at 20% with indexation.

- If sold within 3 years: Short-term capital gains (STCG) added to income and taxed as per slab.

- Wealth tax no longer applicable after 2015.

Digital Gold:

- Gold ETFs & Mutual Funds: Taxed like physical gold.

- Sovereign Gold Bonds (SGB): LTCG is tax-free if held till maturity (8 years). Interest (2.5%) is taxable.

- Digital gold via apps: Treated like physical gold (STCG/LTCG).

11. Safety and Storage: Which Is Safer?

Physical Gold:

- Must be stored at home or in a bank locker.

- Risks include theft, misplacement, or damage.

- Locker rent can be expensive.

Digital Gold:

- Stored in secured, insured vaults.

- No chance of theft or damage.

- Easily accessible online.

Winner: Digital gold for safety and convenience

12. Liquidity: Which One Is Easier to Sell?

Physical Gold:

- Can be sold at local jewellers, pawnshops, or banks.

- May face deductions due to impurities or lack of documentation.

Digital Gold:

- Sold instantly via app/platform at live market price.

- Amount is credited directly to your bank.

Winner: Digital gold for faster and transparent transactions

13. Returns Comparison Over Time

Physical Gold:

- Returns depend on gold price appreciation.

- Reduced by making/wastage charges in jewellery.

Digital Gold:

- Gold ETFs track gold price minus expense ratio.

- SGBs offer 2.5% annual interest + price appreciation.

- No additional charges (unless delivery requested).

Winner: Digital Gold (especially SGBs) for better net returns

14. Ideal Use Cases for Each Type

Physical Gold:

- Gifting on occasions (weddings, festivals)

- Family traditions and heirlooms

- Symbol of social status

Digital Gold:

- Short- and long-term investments

- SIP in gold via platforms

- Portfolio diversification

Easy for students, professionals, NRIs

15. Common Myths and Facts About Gold Investment

1. Myth: Digital gold isn’t real gold.

Fact: It is 24K, 99.9% pure gold, backed by physical reserves.

2. Myth: Physical gold is always more valuable.

Fact: Charges on jewellery reduce actual investment value.

3. Myth: You can’t gift digital gold.

Fact: Many apps now allow gold gifting.

4. Myth: Gold prices only rise.

Fact: Gold is volatile and can fall during bullish markets.

16. Gold Buying Platforms in India (Apps, Banks, Brokers)

- PhonePe, Paytm, Google Pay: Easy digital gold purchase.

- Groww, Zerodha, Upstox: Gold ETFs, SGBs.

- Banks: Offer gold coins, SGB subscriptions.

- MMTC-PAMP, SafeGold, Augmont: Digital gold providers.

17. Expert Tips to Choose Between Physical and Digital Gold

Match your goal with the type:

- Gifting or tradition: Physical.

- Investment: Digital (ETF/SGB).

- For regular saving, start SIP in digital gold.

- For long-term gains, choose SGB (tax-free interest).

- Always check purity and provider credibility.

18. Mistakes to Avoid When Investing in Gold

- Ignoring purity (buying non-hallmarked gold)

- Buying jewellery as investment (loss via charges)

- Not understanding tax implications

- Not comparing platforms and providers

- Selling in panic during short-term price falls

19. Frequently Asked Questions (FAQs)

Q1. Is digital gold safe to invest in?

Yes, if purchased from RBI-regulated or trusted providers.

Q2. Which gives better returns: Physical or Digital?

Digital gold, especially SGBs, gives better long-term returns.

Q3. Can I convert digital gold into physical form?

Yes, many platforms offer home delivery of gold coins/bars.

Q4. Is SGB interest taxable?

Yes, the 2.5% interest is taxable annually.

Q5. Is GST applicable on gold?

Yes, 3% GST applies to both physical and digital gold.

20. Final Verdict: Which One Should You Choose in 2025?

Choose Physical Gold if:

- You need it for family traditions or gifts

- You want a tangible asset

Choose Digital Gold if:

- You want flexibility and safety

- You want to invest in small amounts

- You want better returns with less hassle

Our Recommendation: For serious investors in 2025, Sovereign Gold Bonds (SGBs) are the best way to gain exposure to gold with added interest, no storage hassles, and tax-free maturity gains.

But having a mix of both (20% physical, 80% digital) can give you emotional satisfaction and financial growth together.

thanks for Reading! Give Your Respon

1 thought on “Physical Gold vs Digital Gold in 2025 – A Complete Investment Guide”