Your 20s are the most important period of your life financially. During this period you get an ideal scope to learn your income planning, saving and investing. But, many financial mistakes are made in this era, resulting in huge losses in future.

In this blog, we will tell you about the top financial mistakes you should avoid in your 20s along with useful tips for proper financial planning.

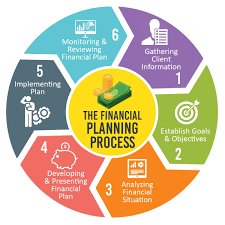

1. Living without financial planning:

Living in your 20s without financial planning is a big mistake. Many people do not keep a record of their expenses, and do not set any goals for money, which leads them to wasteful spending.

What to do:

1. Create a budget:

Set a budget for each month’s income and expenses.

2. The 50/30/20 rule

-50% of income for necessary expenses (like rent, food).

-30% for wants (like travel, shopping).

-20% for savings and investment.

3. Set a financial target:

Short-term goals (saving in advance).

Long-term goals (buying a house, investing for the future).

2. Not having an emergency fund:

Many young people fall back on unexpected expenses by not having an emergency fund. Not having an emergency fund risks running out of money in the event of a sudden job loss or medical illness.

What to do:

1. Determine the Fund:

Accumulate a fund equal to 6 months of your monthly income.

2. Open a separate account:

Open a separate account for emergency fund. This fund should be used only for emergency needs.

3. Choose a liquid investment:

Put the funds in liquid investments, so that they are available quickly.

3. Wasteful spending habit:

Extravagant spending is common in the 20s due to the influence of fashion, technology gadgets, luxury brands and social media.

Example:

-Eating out in restaurants frequently.

-Buying upgraded phones by taking loan.

-Wanting to spend money on dumber hobbies.

What to do:

1. Keep track of expenses:

-Record where and how much money you are spending each month.

-Using finance tracking apps (like Money Manager) for this.

2. Learn the difference between necessary and unnecessary expenses:

Before buying anything decide whether it is really necessary or based on desire.

4. Delaying the start of investment:

“There’s still time” or “I’ll start later” mentality makes young people delay the start of investing. If you start investing at an older age, the benefit of compound interest is less.

What to do:

1. Choose a safe investment option:

-SIP in Mutual Funds: Start small investments every month.

-Diversified Investment: Spread your investment across various instruments (like stocks, FD, real estate).

2. Take advantage of compound interest:

-The sooner you start investing, the higher the interest and benefits.

5. Credit Card Abuse:

Not using credit card properly is a big mistake. Many youngsters focus on making the minimum payment, which leads to a higher interest burden.

What to do:

1. Use only for essential purchases:

-Use credit cards only for important purchases.

2. Make payments on time:

-Pay the balance in full every month, don’t get into the habit of minimum payments.

6. Living on loans

Borrowing is common in your 20s, but a debt habit can hinder financial independence in the future.

What to do:

1. Take a loan only when needed:

-Consider a loan only for short-term emergency expenses.

2. Calculate the loan:

-Consider the interest rate, payment terms and repayment capacity while taking a loan.

7. Being dependent on only one source of income:

Today it is dangerous to depend on only one job or one business.

What to do:

1. Start a Side Hustle:

-Find innovative ways like freelancing, blogging, YouTube channel.

2. Finance Diversification:

-Create multiple sources of income to reduce future risk.

8. Not taking insurance:

Living without medical or life insurance is a risk to the future.

What to do:

1. Take necessary insurance:

-Take health insurance and term plan.

2. Plan the premium for the year:

-Budget in advance for the cost of insurance premium every year.

9. Not trying to learn by yourself:

Many young people don’t understand the difference in financial education, which leads them to make mistakes.

What to do:

1. Read financial books for distribution:

Books: “Rich Dad Poor Dad” “The Intelligent Investor.”

2. Take an online course:

Free courses on finance are available on various platforms.

10. Sacrificing long-term goals for short-term gains:

Sacrificing investment goals that can contribute to a lifetime for short-term pleasures can prove detrimental in the future.

What to do:

1. Prioritize:

Determine your financial priorities for the next 5–10 years.

2. Maintain balance:

Balance short and long term goals.

Conclusion:

Being financially careful in your 20s is very important. Through financial planning, proper investments, and allocations, you can build a strong foundation for your future.

Comment below with your thoughts or questions and also what should be added to this blog!

Start financial planning today and be an inspiring example for the future.