Introduction: The Meaning of Money and Financial Education:

Getting rich is everyone’s goal in today’s times, but many people struggle to achieve this goal without a practical understanding of financial science. Robert Kiyosaki’s famous book Rich Dad Poor Dad is a guide to financial success. The book is based on the different beliefs and financial approaches of two fathers.

The “Poor Dad” was educated, but believed that a job and security were the most important things in life.

“Rich Dad” was a successful businessman, who taught Kiyosaki important lessons in financial education, investing, and building wealth.

In this article, we will elaborate on five very important lessons to be learned from this book.

BUY NOW : “RICH DAD POOR DAD”

Lesson 1: Importance of Financial Education

“School teaches you how to make money, but not how to manage money.”

In this lesson, Kiyosaki emphasizes the lack of financial education, explaining how rich people manage to increase their wealth by managing their money, while the poor and middle class lag behind.

Key Points:

1. Schools never emphasize financial literacy:

Schools emphasize IQ and academic knowledge in the curriculum, but neglect financial learning.

2. Learning the language of money is essential:

In financial science one should understand such terms as:

Assets: Things that increase your money.

Liabilities: Which reduce your money.

Cash Flow: A statement of where money is coming from and where it is going.

3. Investment in Education:

Wealthy people are constantly reading materials to learn new things, adopt new techniques, and improve their financial understanding.

Practical Steps:

-Read financial education books such as Think and Grow Rich or The Intelligent Investor.

-Use a notebook or app to track your daily spending and savings.

-Use online courses or webinars for financial knowledge.

Lesson 2: Difference between Assets and Liabilities (Assets vs. Liabilities):

“Rich people buy assets, while poor people buy liabilities, thinking they are assets.”

The gist of this lesson is that rich people invest in things that increase their income. On the other hand, the middle class invests in things, which look beneficial in appearance but prove to be harmful in the long run.

Key Points:

1. What are Assets?

-Real estate that generates rent.

-Dividend paying shares.

-A business that generates profit.

2. What are liabilities?

-Items taken on loan with high interest, such as cars or expensive gadgets.

-A house, if it only spends and does not generate profit.

3. Understanding Cash Flow:

Your financial health depends on the difference between your income (income) and expenses (expenses).

Example:

If you buy a car, it’s a hobby expense, which reduces the value. But if you earn by renting that car, it is an asset.

Practical Steps:

Before making a purchase, ask yourself: “Will this item add to my income or expense?”

Get rid of the habit of taking loans for expensive hobbies.

Adopt routine low-cost measures and turn them into assets.

Lesson 3: Work to Learn, Not to Earn:

“Stop working for a salary and start increasing your knowledge.”

In this lesson, Kiyosaki explains that a job should be taken not just to earn a salary, but to learn new skills and experience.

Key Points:

1. Importance of skill learning:

-Rich people choose professions or jobs that teach them useful skills in life, such as:

- Sales and Marketing.

- Negotiation and Leadership.

- Financial management

2. Gain other experience:

Knowledge of different walks of life teaches you to think bigger than being confined to a job.

3. Learning from failure:

Failures in your career can be profitable if you take them as learning.

Example:

Kiyosaki himself set out to work as a salesman, as he felt that it was impossible to run a successful business without sales skills.

Practical Steps:

-Start a job or side hustle to learn something new.

-Learn skills related to marketing, finance and communication.

-Analyze your failures with a critical approach.

Lesson 4: Importance of Passive Income:

“You’ll never be powerful enough to make money alone, whereas passive income can give you true financial freedom.”

Passive income is generating money on a permanent basis with little effort on your part. This lesson shows that creating a source of passive income is essential to financial independence.

Key Points:

1. Active Income vs Passive Income:

- Active income: where you have to work continuously to earn money (job).

- Passive income: Where your assets work for you (such as real estate rent or dividends).

2. Importance of multiple sources of income:

- Rich people never depend on a single income. They diversify their sources of investment.

3. Road to Financial Freedom:

- When your passive income exceeds your expenses, you can live comfortably without having to work.

Practical Examples:

- Renting a house.

- Earning dividends in shares.

- Creating digital products or content.

First step:

Start saving your money and gradually build a portfolio for investment.

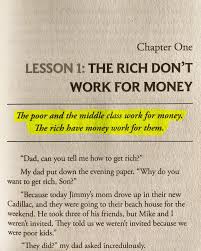

Lesson 5: The Rich Don’t Work for Money:

“Rich people build systems for money instead of making money.”

In this lesson, Kiyosaki explains that rich people do not work for money, but create systems that generate money.

Key Points:

1. Importance of Mindset:

- Rich people see money as a tool and constantly work to grow it.

2. Coming out of the Gem Race:

- Poor people work only for pay, while rich people make their time a valuable asset.

3. Use of leverage:

- Rich people generate more wealth by making good use of other people’s money and time.

Example:

Kiyosaki’s Rich Dad always generated passive income by investing in real estate and business, which he used to find new opportunities.

Practical Steps:

- Stop depending on job to earn money.

- Build your own automated system that generates passive income.

- Make a regular investment budget.

Conclusion:

Rich Dad Poor Dad is not just a book, it is a scripture to change the financial direction of life. The lessons taught in this book will equip you financially, helping you build wealth and move forward in life.

Apply these lessons to your lifestyle today, so that your financial future becomes prosperous.

Be sure to share your opinion and let us know how this lesson changes your life!

1 thought on “Five Important Lessons From Rich Dad Poor Dad that change your life:”