Price-to-Book (P/B Ratio):

In the world of investing and finance, the Price-to-Book (P/B) Ratio is a critical metric that helps investors understand the relative value of a company’s stock in relation to its book value. This ratio is particularly important for assessing the market value of companies in asset-heavy industries such as banking, insurance, and real estate.

What is the Price-to-Book (P/B) Ratio?

The Price-to-Book (P/B) Ratio is a financial metric that compares a company’s market value (its stock price) to its book value (the value of its assets minus liabilities). In simple terms, the P/B ratio tells investors whether a stock is undervalued or overvalued by comparing the stock price to its intrinsic book value.

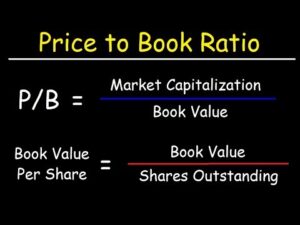

Formula:

P/B Ratio =Market Price Per Share / Book Value Per Share

Market Price Per Share: This is the current stock price of a company as determined by the stock market.

Book Value Per Share: This represents the net worth of a company per share. It is calculated by subtracting the company’s total liabilities from its total assets, and then dividing by the number of outstanding shares.

Why is the P/B Ratio Important?

The P/B ratio is important because it gives investors insight into how much they are paying for a company’s assets relative to their book value. It is an essential tool for investors to assess whether a stock is trading at a fair value or not. A lower P/B ratio may suggest that a stock is undervalued, while a higher P/B ratio may indicate overvaluation.

Step-by-Step Guide to Understanding P/B Ratio:

1. Understanding Book Value:

Before diving into the P/B ratio, it’s important to understand what book value is. The book value of a company is the net value of its assets after all liabilities have been deducted. Book value is essentially the amount that would remain if a company were to liquidate its assets and pay off its debts.

The formula for book value is:

Book Value =Total Assets – Total Liabilities

2. Calculating the P/B Ratio:

Once you have the book value, the next step is to calculate the P/B ratio. To calculate the P/B ratio, you need to know the market price per share and the book value per share.

Here’s an example:

Let’s say a company has a market price of ₹500 per share and a book value per share of ₹200.

P/B Ratio = 500/200 = 2.5

This means that the stock is trading at 2.5 times its book value.

3. Interpreting the P/B Ratio:

Once you have the P/B ratio, you can interpret it in the following ways:

P/B Ratio = 1: A P/B ratio of 1 indicates that the market value of the company is exactly equal to its book value. This could mean that the market considers the company’s assets to be fairly valued.

P/B Ratio > 1: If the P/B ratio is greater than 1, it suggests that the market is willing to pay more than the company’s book value for its assets. This could indicate investor optimism about the company’s future growth prospects. However, a high P/B ratio could also signal overvaluation.

P/B Ratio < 1: A P/B ratio less than 1 indicates that the stock is trading below its book value, suggesting that the market believes the company’s assets are worth less than what the company is reporting. This could indicate an undervalued stock, or it could suggest that the company is struggling with profitability or growth.

4. What Does a High P/B Ratio Indicate?

A high P/B ratio (greater than 1) means that the market is willing to pay more for the company’s assets. It could indicate the following:

Investor Confidence: The higher the P/B ratio, the more confident investors are about the future earnings and growth of the company.

Good Intangible Assets: A high P/B ratio could also mean that the company has valuable intangible assets, such as brand value, intellectual property, patents, or strong market leadership.

However, it is important to note that a high P/B ratio doesn’t always guarantee success. Investors should dig deeper into why the market is valuing a stock highly and whether the company’s growth prospects justify this high valuation.

5. What Does a Low P/B Ratio Indicate?

A low P/B ratio (less than 1) can suggest several things:

Undervalued Stock: A P/B ratio below 1 can indicate that the stock is trading below its book value, which may imply that the stock is undervalued. This can present a potential buying opportunity, but investors need to be cautious.

Financial Troubles: A low P/B ratio can also indicate that the company may be facing financial difficulties, such as declining earnings, heavy debt, or problems with asset management. The market might be pricing the stock lower due to concerns about the company’s ability to generate profits.

6. Limitations of the P/B Ratio:

While the P/B ratio is a valuable tool, it’s important to keep in mind its limitations:

Not Useful for All Companies: The P/B ratio is more useful for asset-heavy companies (like banks and real estate companies) because it directly relates to the value of physical assets. For companies in technology or service industries, where intangible assets (like intellectual property and human capital) are more important, the P/B ratio may not give an accurate picture.

Ignores Market Conditions: The P/B ratio does not take into account macroeconomic conditions, market sentiment, or industry trends. Therefore, it should not be used in isolation to assess the value of a stock.

Impact of Depreciation: The P/B ratio is based on book value, which reflects the company’s assets after depreciation. If the company has significant depreciating assets, its book value might not reflect the true market value of those assets.

How to Use the P/B Ratio for Investment Decisions:

The P/B ratio can be a valuable tool for identifying potential investment opportunities. Here’s how you can use the P/B ratio in your investment strategy:

1. Look for Undervalued Stocks: A P/B ratio below 1 can indicate that a stock is undervalued. This might present an opportunity for investors to purchase the stock at a lower price relative to its book value.

2. Compare Companies in the Same Industry: To make a meaningful comparison, you should compare the P/B ratio of a company with its peers in the same industry. For example, comparing the P/B ratios of two banks will give you a better idea of which one is undervalued or overvalued.

3. Check Historical P/B Ratios: Compare the current P/B ratio of a company with its historical P/B ratio. If the current ratio is lower than the historical average, it could indicate that the stock is undervalued.

4. Consider the Company’s Growth Prospects: A high P/B ratio could indicate growth potential, especially if the company has a competitive advantage, strong brand, or high barriers to entry. But remember, high valuations don’t always equate to strong performance in the future.

Conclusion:

The Price-to-Book (P/B) ratio is a crucial metric that helps investors assess whether a stock is under or overvalued. While it is a valuable tool, it should not be relied upon solely for making investment decisions. By understanding the factors that influence the P/B ratio and using it in conjunction with other financial metrics, you can make more informed investment choices.