Introduction:

Both saving and investing are important in today’s times. Recurring Deposit (RD) Account in Bank and Systematic Investment Plan (SIP) Both are popular options especially for small investors and salaried people. But which one is more rewarding? Should choose safe RD or SIP for higher returns?

In this article, we will compare RD and SIP on the basis of returns, risk, liquidity, tax benefit and long-term investment, so that you can take the right decision.

1. What is Recurring Deposit (RD)?

Recurring Deposit (RD) is a safe investment option offered by banks and post offices. In it, the investor deposits a fixed amount every month and gets back the principal along with interest after a fixed period.

1.1 Features of RD:

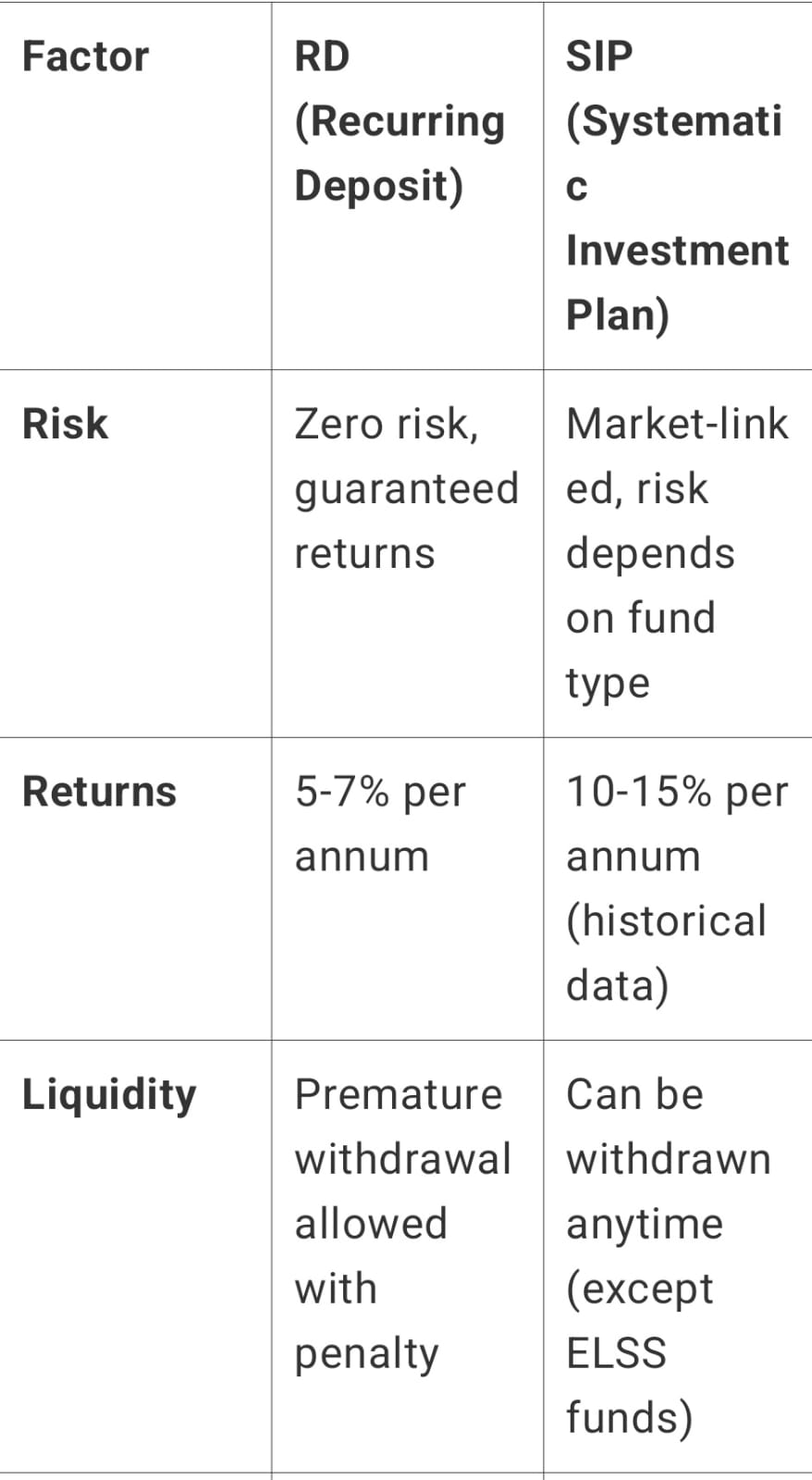

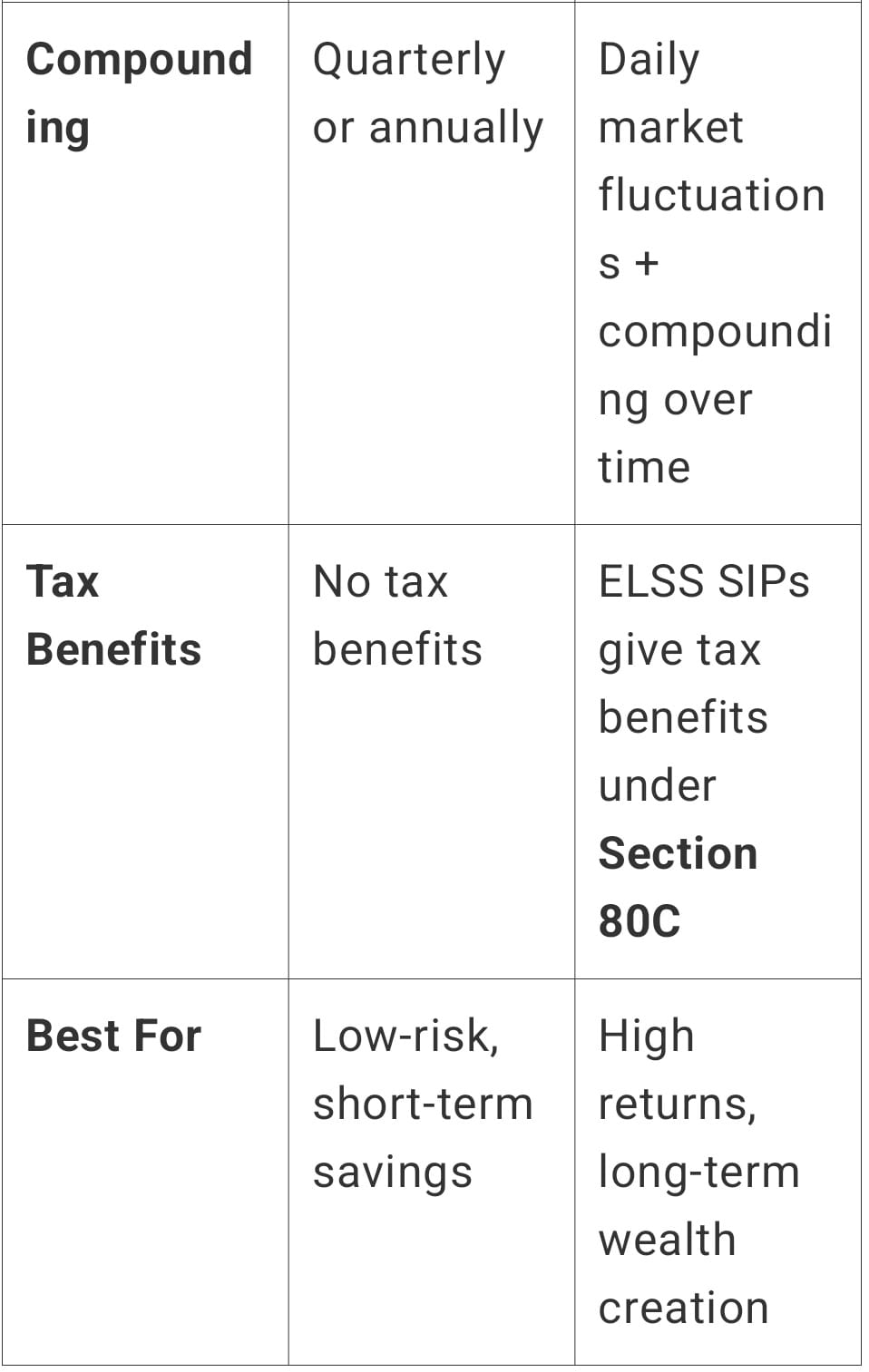

✅Fixed Return – Interest rate fixed by banks.

✅No risk – your capital is fully protected.

✅Fixed Tenure – Usually ranges from 6 months to 10 years.

✅Regular savings habit – Ideal for individuals who want to save small amounts systematically.

1.2 Advantages of RD:

✅Safe and Guaranteed Return: Capital is safe with fixed interest rate.

✅Flexible Tenure: Available for short to long term periods.

✅Best for Short Term Target: If you need to save for 1-3 years, RD is best.

✅Safe Investment: Since banks and post offices offer RD, it is considered highly secure.

1.3 Drawbacks of RD:

❎Low returns: 5-7% interest rate, which may be lower than inflation.

❎Limited Liquidity: Penalty for early withdrawal.

❎Tax applicable: Interest earned on RD is taxable as per your income tax slab.

BUY NOW:

2. What is a Systematic Investment Plan (SIP)?

Systematic Investment Plan (SIP) is a way of investing in mutual funds, where a fixed amount is invested every month. Through SIP you can invest long term in share market and mutual funds.

2.1 Features of SIP:

✔️Market-Links Returns – Unlike investments, returns depend on market performance.

✔️High Return Potential – Historically SIP can give 10-15% annual returns.

✔️Flexible investment amount – SIP can be started as low as ₹500 per month.

✔️Benefit of Compounding – Greater benefit in the long run.

2.2 Advantages of SIP:

✔️High Returns: Superior to get much higher returns than RD.

✔️Diversification: Investment in different sectors of mutual funds.

✔️Tax Benefit: If you invest in ELSS mutual funds, you get tax savings under Section 80C.

✔️Flexible and highly liquid: You can stop the investment whenever you want.

2.3 Disadvantages of SIP:

✖️Market Risk: The cost of investment depends on the value of the stock market.

✖️No guarantee: higher risk than RD, but better benefit in long run.

✖️Long term investment required: Investment is required for 5-10 years.

3. RD vs SIP: A Comparative Analysis

4. Who should choose RD and who should choose SIP?

Choose RD if:

- You are looking for 100% safe investment.

- Your target is short-term (1-3 years).

- You don’t want to get caught up in the ups and downs of the market.

Choose SIP if:

- You want higher returns.

- Your investment is long term (5+ years).

- You want tax savings and wealth creation.

5. Frequently Asked Questions (FAQs):

Q1. Can I invest in both RD and SIP?

➡️ Yes, you can invest in both as per your financial goals.

Q2. Which is better – RD or SIP?

➡️RD is best for short term investment, while SIP is best for long term and higher returns.

Q3. Does SIP offer more tax benefits than RD?

➡️Yes, tax savings of up to ₹1.5 lakh is possible under Section 80C in ELSS SIPs, while there is no tax saving in RD.

Q4. Can money be lost in SIP?

➡️SIPs are market-linked, so there is risk in the short term, but in the long term SIPs can give returns of up to 10-15%.

Q5. How much should I invest in SIP every month?

➡️Invest at least 20% of your salary in SIP.

6. Final thought: RD vs SIP – Which is better?

There is no one-size-fits-all answer to whether RD or SIP is better. It depends on your financial goals:

✔ If you want 100% safety and fixed returns, choose RD.

✔ If you want higher returns and wealth creation, go for SIP.

✔ If you are a beginner, you can start with RD and gradually shift towards SIP as you become comfortable with investing.

Final Tip: If your goal is wealth creation and high returns, then SIP is a better choice. RD is best if investing for safety and low risk.

Which you want to choose? Comment!